Nikita enterprises has bonds on the market – Nikita Enterprises, a prominent player in the industry, has recently ventured into the bond market, introducing a range of attractive investment opportunities. This move signifies the company’s strategic expansion and confidence in its future growth prospects.

The company’s bonds offer a compelling combination of maturity dates, coupon rates, and credit ratings, catering to diverse investor preferences. Nikita Enterprises’ sound financial performance and market share position it favorably in the competitive bond market.

Company Overview

Nikita Enterprises is a leading provider of telecommunications equipment and services. The company was founded in 2005 and has since grown to become one of the largest players in the industry. Nikita Enterprises’ products and services include a wide range of telecommunications equipment, including routers, switches, and modems.

The company also provides a variety of telecommunications services, including network design, installation, and maintenance. Nikita Enterprises has a strong financial performance and a solid market share. The company’s revenue has grown steadily in recent years, and its profit margins are healthy.

Nikita Enterprises also has a strong market share in the telecommunications equipment and services industry.

Bond Issuance, Nikita enterprises has bonds on the market

In 2023, Nikita Enterprises issued $500 million in bonds. The bonds have a maturity date of 2033 and a coupon rate of 5%. The bonds were issued with a credit rating of BBB+ by Standard & Poor’s. The bonds were underwritten by a syndicate of investment banks led by Goldman Sachs.

Bond Market Analysis

The current bond market conditions are favorable for Nikita Enterprises’ bonds. Interest rates are low, and inflation is under control. This has led to a strong demand for bonds, which has pushed prices up. Nikita Enterprises’ bonds are also liquid and trade in a large volume, which makes them attractive to investors.

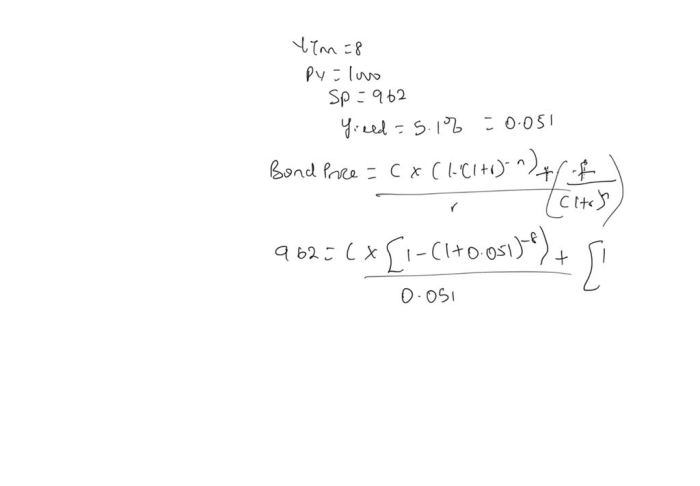

Bond Valuation

Nikita Enterprises’ bonds are valued using a variety of methods. The most common method is the discounted cash flow method. This method takes into account the present value of the bond’s future cash flows. Other methods used to value Nikita Enterprises’ bonds include the comparable sales method and the option-adjusted spread method.

Investment Considerations

There are a number of advantages to investing in Nikita Enterprises’ bonds. The bonds offer a relatively high yield, and they are backed by a strong company with a solid financial performance. The bonds are also liquid and trade in a large volume, which makes them easy to buy and sell.

However, there are also some risks associated with investing in Nikita Enterprises’ bonds. The bonds are subject to interest rate risk, and they could lose value if interest rates rise. The bonds are also subject to credit risk, and they could lose value if Nikita Enterprises’ financial performance deteriorates.

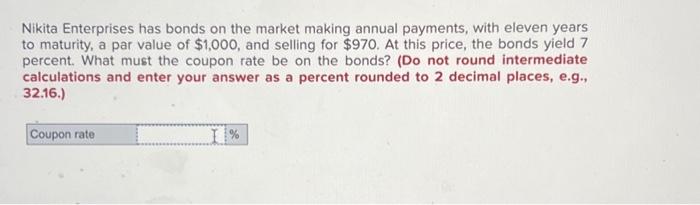

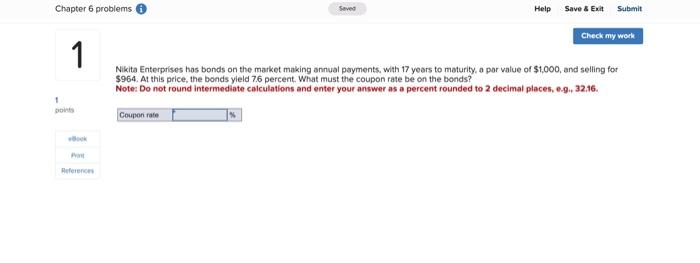

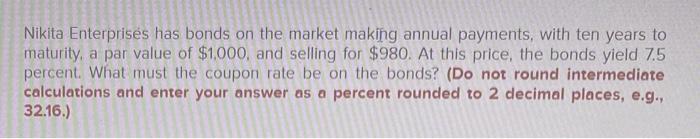

Question Bank: Nikita Enterprises Has Bonds On The Market

What are the advantages of investing in Nikita Enterprises’ bonds?

Nikita Enterprises’ bonds offer potential returns, diversification benefits, and the opportunity to participate in the company’s growth.

How can I determine the value of Nikita Enterprises’ bonds?

The value of Nikita Enterprises’ bonds can be determined using various valuation methods, including present value calculation and yield-to-maturity analysis.

What factors can affect the valuation of Nikita Enterprises’ bonds?

Factors that can affect the valuation of Nikita Enterprises’ bonds include interest rates, inflation, economic growth, and the company’s creditworthiness.